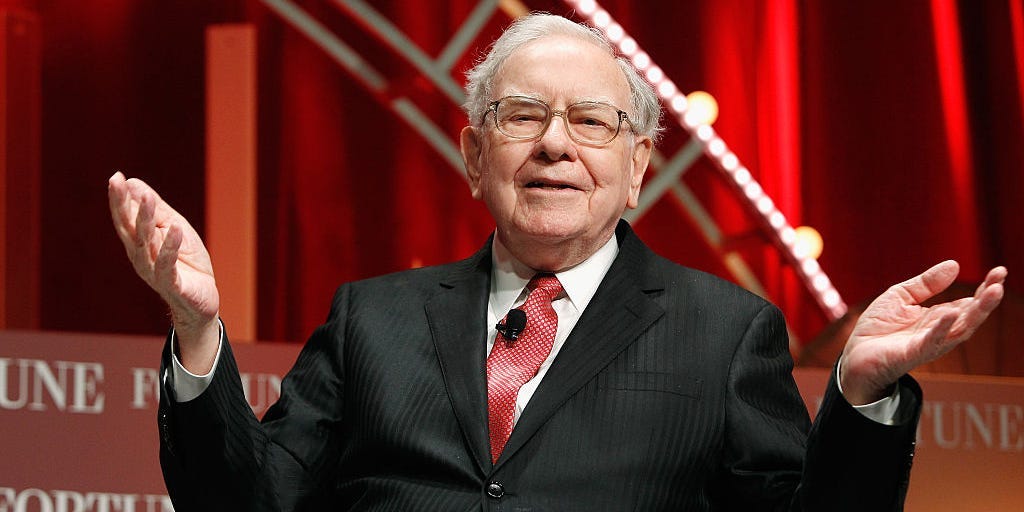

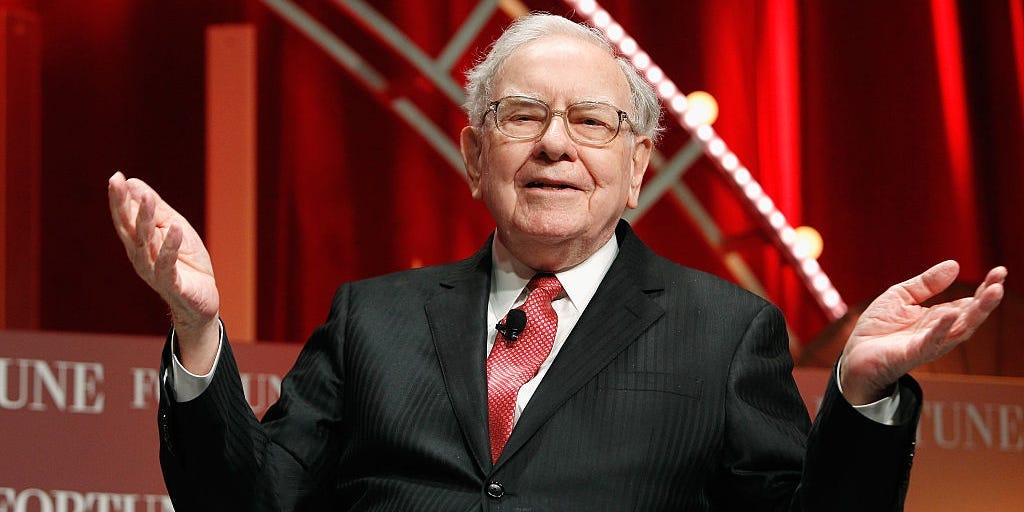

- Warren Buffett has previously noted the absurdity of his secretary paying a higher rate of tax than him, and acknowledged the rich are waging a class war and winning it.

- Those admissions by the billionaire investor and Berkshire Hathaway CEO were “extraordinary,” Kurt Andersen, author of “Evil Geniuses: The Unmaking of America,” recently told Yahoo Finance.

- “All boats stopped rising together all at once around 1980 and it wasn’t by accident,” he said, referring to the widening wealth gap.

- Andersen added that Buffett’s long-term, passive investing strategy is better for society than the “cut-and-run, private-equity driven system, and day trading without any commitment to anything.”

- Visit Business Insider’s homepage for more stories.

Warren Buffett famously said he should pay a higher tax rate than his secretary, and the wealthy are waging a class war and winning it.

Those were “extraordinary” admissions by one of the world’s wealthiest men, Kurt Andersen, author of “Evil Geniuses: The Unmaking of America,” said in a Yahoo Finance interview published this week.

When Buffett openly acknowledged class warfare, he “was not immediately joined by a throng of fellow famous billionaires and thousands of superrich in a great public display of blunt candor and contrition about having been on the winning side of America’s new Raw Deal,” Andersen wrote in his book.

The lack of support may have reflected the honesty of the investor's comments.

"It wasn't just a poetic notion," Andersen said in the interview. "There really had been since the 1970s a kind of class war on the part of the rich to transform the economy."

While economic growth and productivity climbed, "all boats stopped rising together all at once around 1980 and it wasn't by accident," he added.

Buffett warned earlier this year that wealth inequality will worsen as the capitalist system increasingly rewards people with in-demand skills and neglects others, unless the government intervenes.

The Berkshire Hathaway CEO feeds that dynamic by backing some businesses, but not others. However, Andersen argued his signature strategy of long-term, hands-off investments is better for society than more modern alternatives.

It's "much closer to optimal than the cut-and-run, private-equity driven system, and day trading without any commitment to anything," he said.